General insurance professionals

The time when customers can feel the value of insurance is when there is an accident. As insurance is an intangible product when there is an accident is the time when humanity of the Claims Department employees is most tested.

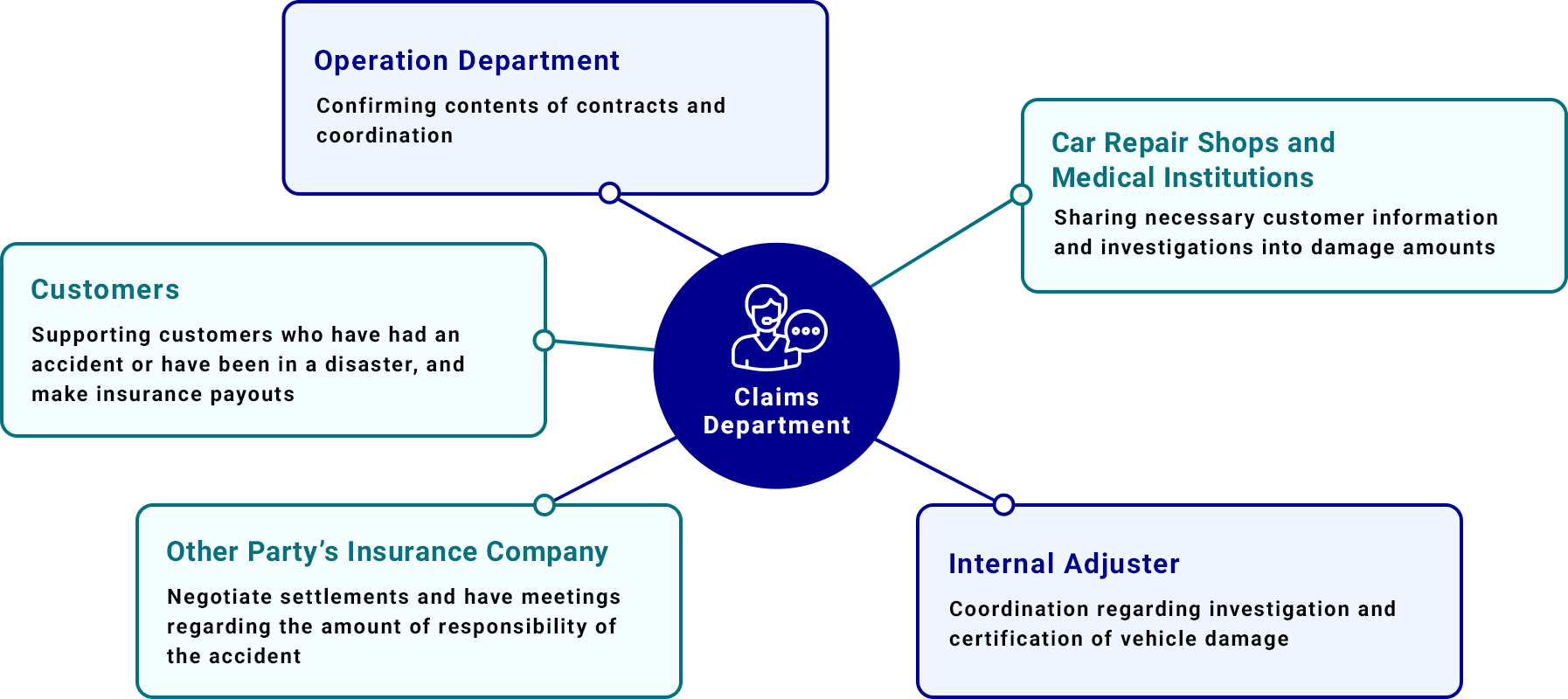

The Claims Department works hard to bring solutions to accidents or disasters, and ultimately through insurance payouts fulfill the role of providing safety and security to customers. More specifically, the Claims Department is responsible for the process from accident reporting until insurance payout, coordination with people involved in the accident, the other party’s insurance company, lawyers, car repair shops, and medical institutions, and the calculation and assessment of the damages. They also hold the vital role of when there is an accident, to negotiate through discussion with the other party’s insurance company regarding percentage of liability (fault) each party has until a settlement is reached.

The amount of time taken to reach a solution varies greatly depending on the type of accident, and there are cases where reaching a solution takes months or even years. Another important role of the Claims Department is to be on the customers' side, to guide and support them as a partner until resolution.

What is unique about the job of the Claims Department employees, is that they have the contrasting roles of being the person who assesses and makes payouts, as well as being the person who provides reassurance to customers. This means that those in the Claims Department have a lot of responsibility, but they are fighting on the front line with the strong mission to protect and provide peace of mind to customers. The Claims department, as professionals in both general insurance and accident response, with a great deal of knowledge and expertise, support customers until resolution. Not merely just making payouts but continuing to support customers as a partner. The Claims Department brings this AXA vision to life.